Each person’s reason for giving to charity might be different. People’s decision to make a donation to an NGO can be driven by altruism and social impact, social responsibility, personal connection, awareness and advocacy, religious or cultural values, tax exemptions and more.

In a bid to incentivise charitable giving, governments often make provisions in taxation laws. In India, for instance, Section 80G of the Income Tax (IT) Act makes a donation above ₹500 to a registered charitable organisation eligible for tax exemption.

What is Section 80G?

In a clear indication of the government’s support to philanthropic efforts, Section 80G of the Income Tax Act allows individuals to deduct charitable contributions from their taxable income. Taxpayers should be aware, nevertheless, that not all nonprofits or charitable organisations are eligible to offer donors a Section 80G deduction.

A taxpayer, whether an individual, corporation or partnership, may deduct contributions made to registered non-profit organisations and relief funds under Section 80G from taxable income. Depending on the organisation’s registration, donations may be subject to Section 80G taxation at 100 per cent or 50 per cent with or without restrictions.

Triple Win: Feed Children. Earn Goodwill. Save Tax.

The Akshaya Patra Foundation, an NGO in India, feeds hot and wholesome meals to children in government schools. Akshaya Patra is registered under Section 80G of the Income Tax Act, which exempts donations over ₹500 from one’s taxable income. This is particularly beneficial because tax payers can save money by contributing to the NGO, which in turn serves as an ambassador of hope and dreams while also nourishing and educating young minds throughout India.

Not only does Akshaya Patra offer mid-day meals, but it has also consistently taken the initiative to undertake food assistance as a part of the humanitarian relief. Whether it was flood, cyclone, or earthquake, as a responsible NGO, the Foundation has always worked diligently within the country and abroad to provide relief to people in the aftermath of a disaster.

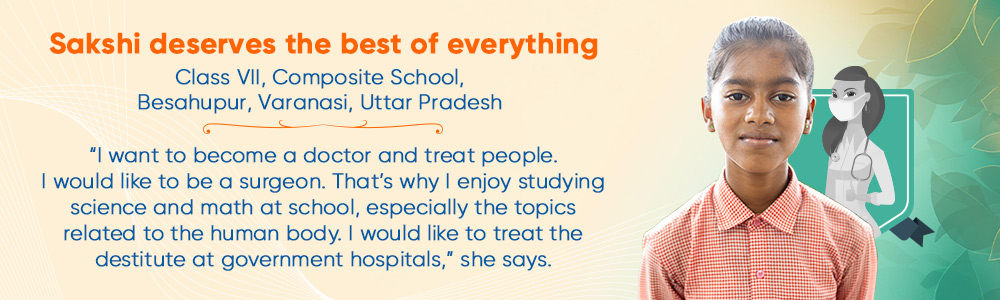

Sakshi lives with her mother, father, brother and grandmother. After she reaches home from school, she helps her mother with chores. She then watches dance shows, studies for a while and completes her homework from school and coaching classes.

“My father is a farmer. My grandmother also works in the field. We grow wheat, rice, spinach and coriander. I help them out when I get time. I pluck the spinach and get the bundles on my bicycle. Then I wash them. My mother has a shop to sell daily-use items for women. I go there to help her out. Then I return home and wash the dishes etc.,” says the 13-year-old.

Sakshi gets mid-day meals at school that help her be on her toes. “I get dal chawal, subzi roti, khichdi kheer etc. However, I like subzi roti more than the others. Our teacher told us that we get these meals from Akshaya Patra,” she says. Sakshi had the opportunity to visit Akshaya Patra kitchen with her father. “My father and I saw how the rotis and subzi are made in big machines. He was impressed by the scale at which the food is prepared. On the days I get my favourite mid-day meal, I am so happy that I come home and tell my mother about it!” she laughs.

When you contribute Akshaya Patra, you are eligible for a 50% tax exemption under Section 80G since The Foundation is enlisted under Section 12A(a) of the Income Tax Act, 1961.